USDA SUBSIDIZED vs USDA GUARANTEED: What is the Difference?

Thursday, February 20, 2020

*** Michelle's February Tip of the Month ***

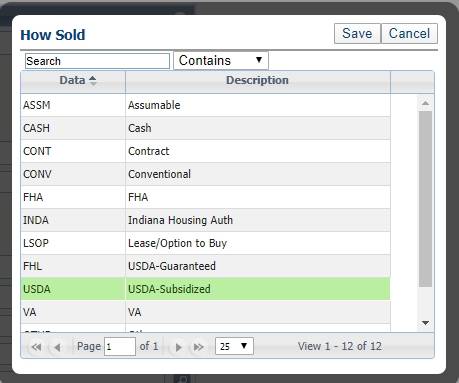

USDA Subsidized (USDA Direct) Loan

USDA direct is a subsidized loan where the government pays (subsidizes) a portion of the payment. This loan is for low to very low income earners. For example, based on their income if they only qualify for a payment of $800.00, but their fully amortized payment would be 1,000.00, the government would then pay (subsidize) the needed $200.00. When they sell the home, they may have to pay back what was subsidized or at least a portion of it. These loans are originated directly with the USDA office. The USDA requires they apply for traditional financing to pay off their loan every one to two years. If they cannot get financing then they are allowed to continue with the loan; however, the USDA Subsidized loan is not designed to keep forever.

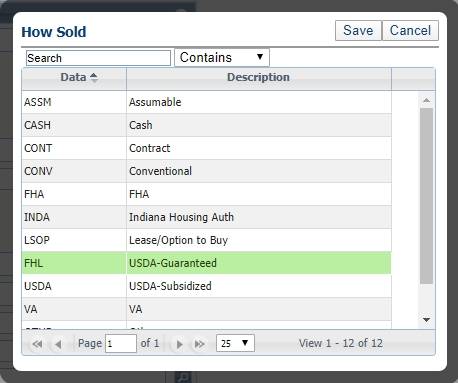

USDA Guaranteed Loan

The USDA Guaranteed loan is not subsidized and they must qualify on the fully amortized payment on their own. This is for moderate income earners. USDA Guaranteed does not allow income producing properties or purchases on existing manufactured houses. USDA Guaranteed is 100% financing and requires no down payment. Not all counties qualify, but Kosciusko County is qualified for this loan (unless it’s manufactured or income producing). They are income based, so household income cannot exceed a certain level to be able to qualify, depending on how many are in the family.

A special thank you to Brenda Rash from Ruoff Mortgage for all of her help with this Tip of the Month!